Due to a combination of factors, businesses are finding it increasingly difficult to navigate the current economic landscape. In this post, we explore the causes behind this phenomenon and show you how Gellyfish Commercial can help your business.

A Complex Landscape

From the pandemic to a global supply chain crisis, businesses are facing unique challenges these days.

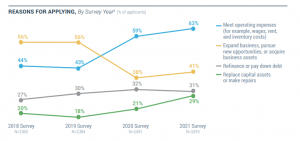

According to data from the Federal Reserve, 63% of the small business owners who sought loans during 2021 needed the funds not to expand their business but to cover operating expenses.

Source:https://www.fedsmallbusiness.org/

As we covered in a previous post, inflation is another factor driving up the pressure on small businesses. Information from the Bureau of Labor Statistics shows that inflation hit a 40-year peak in March 2022, with the Consumer Price Index rising by 8.5% for the year ended in March.

As a response to the rising inflation, the Federal Reserve is raising interests rates. In other words, the cost of borrowing money is going up.

Add to the mix the complex approval process that business owners must go through in order to get funds from traditional banks, and it’s easy to see why many business owners are feeling burned out.

Luckily, Gellyfish Commercial is here to help.

How Gellyfish Commercial Can Help

At Gellyfish Commercial, we understand the complex scenario business owners face. That’s why our services are designed with flexibility and simplicity in mind.

We offer a full range of financing options — no matter what your needs are, we have a solution for you.

- Conventional loans. Ideal when you have a solid credit history and are looking for a loan with flexible terms.

- SBA loans. This is the alternative if you have difficulties meeting the stringent requirements of bank loans and need longer repayment terms.

- Bridge loans. Want fast cash to finance a real estate sale or improve your business? A bridge loan is the answer.

- Revenue-based loans. If you have bad or non-existent credit history, a revenue-based loan may be the option for you. Here, you repay the funds not in fixed installments, but with a percentage of your profits.

Plus, when you need to get in touch with a representative, all you have to do is to fill out the contact form or use the live chat on our home page. It couldn’t be easier!

Gellyfish Commercial: Certainty of Execution in Commercial Loans

If you need a commercial loan in California, or anywhere in the United States, Gellyfish Commercial can help.Contact us today by email (info@gellyfishcommercial.com), telephone (877-800-4493), or social media (Facebook, Twitter, LinkedIn), to schedule a free consultation or to learn more about our financing solutions.